In 2017, about 52% online hotel bookings in USA and 71%% of all online bookings for independent European hotels will be made on OTAs. Most often they are the first point of call for potential guests. Studies suggest, OTAs spend an average of USD 300 per hotel on promotions and marketing. For hotels to compete with OTAs on their own in digital marketing, the cost can go up to USD 7,000 to USD 10,000. The trade-off between OTA commissions and direct customer acquisition cost remains a paradox for many hotels. While larger brands with a substantial marketing budget can compete with OTAs on visibility and presence, independent properties have to depend on OTAs for brand awareness, given their budget constraint.

Five Things for Hotel Revenue Managers’ Checklist in 2017

2017 is going to be the year when online finally overtakes offline in Europe. We all have been listening to online becoming big, and getting bigger – but the reality was that offline travel bookings continued to get the lion’s share. All that is set for change though, as digital travel penetration in the continent finally crosses the halfway mark to reach close to 52% of all bookings by end of 2017, per PhoCusWright. With North America, also closing in to the tipping point, and Asia Pacific catching up faster than the average with 23% growth in digital sales, it’s time for hotels to take corrective actions.

In this article, we share what we think hotels need to capitalize on for stronger performance in the coming months.

1. Do warm up to Demand Analytics

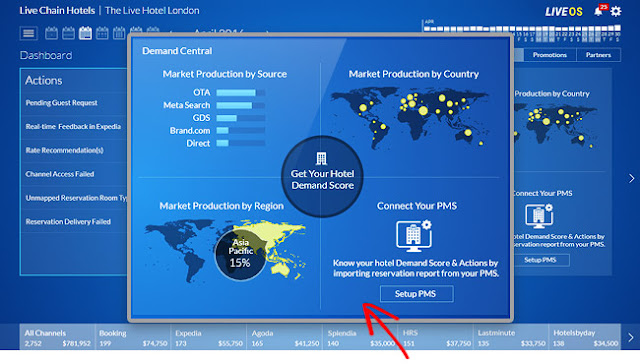

Rate intelligence for years have focussed on shopping rates for competitor set selected by the hotel. While monitoring rate of local competitors is vital, focussing on a small subset of the overall market, hotels often overlook the larger picture, missing out the demand data on most productive sources of business in their market. Advanced demand analytics solutions, like Demand Central, helps hotels measure their performance relative to their market performance from vital sources, like channels and regions and suggest situation-specific and channel-specific actions and alerts to increase business.

2. Do make friends with OTAs

For long, hotels and OTAs have been in a tumultuous frenemy relationship. For hotels, OTAs were a disruption which they had to accept, however reluctantly. With the newest disruption looming over hotel industry in the form of Airbnb, hotels need more than ever to improve their presence in OTAs. With more people preferring experience over everything when it comes to travel, and Airbnb slowly consolidating its presence even on the luxury market, no hotel is in safe zone now. OTAs with their reach and marketing power can help hotels to increase exposure and improve online business.

Stay tuned for part two of this series which will be posted in next week.