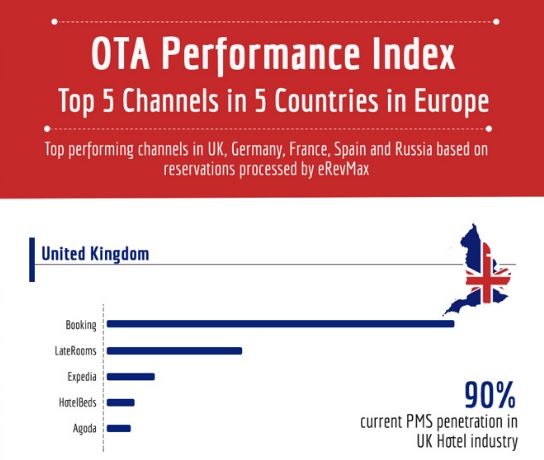

eRevMax lists out Top 5 Channels in 5 Key European Markets

Top Online Travel Trends to Watch in United Kingdom this year

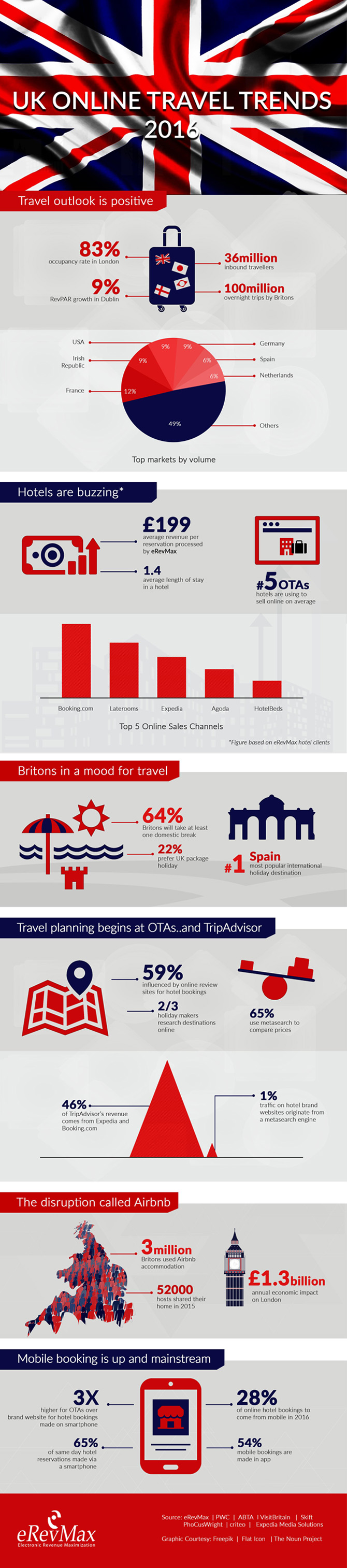

United Kingdom is the eighth popular country in the word in terms of international tourism destinations. The country has attracted 34.4 million travelers in 2015, a 5.6 percent growth compared to the last year.

eRevMax, the leading hotel technology provider, has released an infographic showcasing online travel trends in the United Kingdom. The infographic has projected a positive outlook for UK hoteliers, who can expect to see a lot of bookings coming their way not only from international travelers but from Britons too, as a good 64% of them will take at least one domestic holiday.

Hotels using eRevMax solutions generated an average of GBP 199 per booking with average length of stay being 1.4 across properties. As per eRevMax production statistics, just like rest of Europe, Booking.com has a clear dominance over online hotel bookings followed by Laterooms, Expedia, Agoda and hotelbeds.

Further, this infographic focuses on traveler buying behavior to give hoteliers a deeper insight. It is interesting to note that travellers visit around 17 OTAs during their travel planning phase and over 59% travelers are influenced by online reviews, especially for hotel bookings. Over 65% travellers use metasearch to compare prices thereby making it vital for hotels to manage online reviews effectively and engage actively with metasearch channels.

See full story on eRevMax website here.

eRevMax predicts hotel online distribution trends 2014

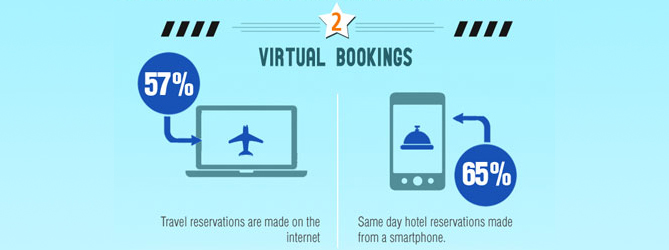

Travelers who book hotel rooms online are increasingly equipped with smart phones and tablets. The infographic shows 7% of all bookings were generated from mobile and tablet devices in 2013, and this trend will grow by another 20% this year. In 2014, hotel bookings through mobile will contribute over $26 billion.

The eRevMax study sheds light on how metasearch sites realized a 13% increase in 2013. Google Hotel Finder, TripConnect and Trivago are becoming a driving force in hotel online distribution as 60% of travellers shop by comparing rates on these sites. To shift market share from the OTAs to direct bookings, hoteliers should utilize metasearch sites as a part of their overall distrbution strategy as it offers better search experience and allows the traveller to find the lowest prices available online.

Bookings from OTAs surged ahead with a 12% rise in Q3 2013 and now stands at 13% of overall bookings in North America. It also shows that 33% of all bookings take place at the brand’s website, an increase of 5% in Q3 2013. eRevMax suggests hoteliers work with OTAs to increase revenues and implement reputation management solutions for quick responses to their guests.

Another important tip by the hotel solutions provider is to leverage the billboard effect, defined as the increase in offline bookings of a property when it is listed with an Online Travel Agency (OTA). An experiment conducted by Cornell University observed that one of the participant hotels experienced an impressive 14% increase in direct bookings when it contracted with an OTA. Besides, Average Daily Rate (ADR) increased by 1.5% during OTA listing of the same property.

In this world of social media, SEO and analytics, failure to adopt digital platforms in their marketing strategy is suicidal for hotels. The data shows that 81% of tech-savvy travellers find user reviews important, while 49% travellers book hotel only after reading reviews. Nearly 21% used Facebook to search for hotel information at least once while 14% of travellers use the Facebook platform to book a hotel room. Hence, it is imperative that hotels take social-commerce seriously.

To access the full infographic, click Infographic: Online Hotel Distribution 2014

Top 5 Trends in Hotel Technology: Infographic

Additionally, 40 percent of travellers travels with three or more electronic devices, so mobile optimised websites are one of the most important factor to the tech-savvy travellers these days. eRevMax suggests hoteliers to provide the service for free to guests who enroll for their select programs, for starters. Such services may be made exclusive for gold and platinum level members or accessible in lobbies of full-service properties.