SUMMARY

Under the eye of storm for a while, Rate Parity has become one of the biggest challenges for hoteliers today. Is it just another headache or will it turn out to be the primary influencer when it comes to online sales? Is rate parity restricting your ability to maximize your revenues or presenting an opportunity to go for fairer Net Based Parity. With the recent UK Office of Fair Trade’s ruling, hotel industry is debating whether this finally brings the death nail for parity as we know it. But does end of parity going means end of worry for hoteliers? Let’s explore the ongoing debate over rate parity and what it means for the hotel industry.

Main Article

The issue of hotel rate parity has become an industry hot potato - from being termed as a ‘necessary evil’ to outright ‘illegal’ – rate parity has been the center of highly charged industry discussions, and often cited as the biggest worry for hoteliers.

What is Rate Parity?

Rate Parity is generally included as a primary clause into online travel agents’ (OTA) agreements which makes it the hotel’s responsibility to ensure that a given hotel room on a given day is selling for the same rate on all channels. For many industry pundits, this is a direct violation of competitive pricing and is against consumers’ best interest. In August 2013, the U.K.’s Office of Fair Trading (OFT) directed major OTAs to relax contractual restrictions, which would allow other booking agencies to provide discounts on “room only hotel accommodations”. Closer on the heels, German and French regulators are also keeping rate parity under the microscope. So does that signal a death sentence for rate parity?

At the cost of being risqué, I would like to play the role of the devil’s advocate and examine what would happen if there was no rate parity.

A World without parity

In the absence of rate parity mandates, the hotels - especially the independent properties, would be in a better position to manipulate rates. But does that ensure better rates and higher revenues? As a consumer, you might not mind paying extra for the experience of shopping in a luxurious mall but I would argue that the online purchasing experience through the majority of travel websites is very similar and ultimately the buyer’s final decision will be driven by price.

For years, the hotel industry has been under the impression that rate parity is the root-cause for everything that has gone wrong with pricing. It’s high time they do a reality check. The truth is that at a time when the majority of the world population is connected through the internet and information is readily available, consumers today have a plethora of options to find the best deals. A hotel room for a given night can be researched and booked through multiple avenues, such as the hotel’s own brand website, online travel agencies, flash sites, opaque sites, review sites and in many cases, social networking sites.

OFT ruling & its long term implications

Much has been written about the recent OFT ruling, and its long term implications. Without going into the finer details, the verdict gives hoteliers and third party distributors in the UK, the right to offer discounts to “closed groups” such as members of their loyalty program. The most common ‘deals’ usually revolve around advance purchases or no-cancellation policies, adding an extra night or value added services into the rate, as well as offering preferential rates to specific customer types, such as loyalty program members. It is widely expected that mature markets like the rest of Europe and US will go the same way.

Does this mean hotels will now regain control of their pricing? For some time many smaller OTAs have been demanding that they be allowed to sell rooms at whatever rate they choose, and without the constraints of rate parity they could start undercutting the brand site and other OTAs. This strategy could backfire on the channels as it is very likely that chain hotels, who are in favor of having the best rates on their brand website (let’s not forget, franchisors were the ones who initiated rate parity in the first place), could live without the smaller channels who chose to undercut and diminish the hotel’s brand value. Even the global OTAs might find themselves marginalized if the chains believe their brands very strong and do not need OTAs to fill its rooms.

In fact, industry watchers believe that the next war will be fought over loyalty programs between the OTAs and major hotel brands. Elimination of rate parity might trigger ‘price cannibalism’ between OTAs and brand sites that could (at least potentially) lead to a worse-case scenario for the industry as a whole.

But what about independent hotels? They are the ones who rely more on OTAs to deliver bookings. It’s the independent and smaller hoteliers who may have to bear the burden of these rulings on rate parity. Being smaller players at the negotiation table, they have significantly less leverage with big third party distribution partners when it comes to commercial agreements and substantially less marketing spend than the big brands to drive direct traffic. The OFT ruling will help them to promote discounted rates to their closed groups but these closed groups will be small and the OTAs which would surely use their marketing muscle and loyalty programs to drive the majority of online business in their direction.

Meta-Search - Friend or foe?

With the annual revenue from the travel industry crossing $1000 billion, everyone wants to have a share of the pie, and meta-search is emerging as a serious player. From Google to TripAdvisor to Priceline (through their acquisition of Kayak) all the major players are entering the game. Metasearch sites typically conduct searches across multiple travel sites and allow the user to compare best rates and availability. OTAs with their technical superiority and larger marketing spend on PPC are the early adopters to integrate with meta-search engines, resulting in better placements.

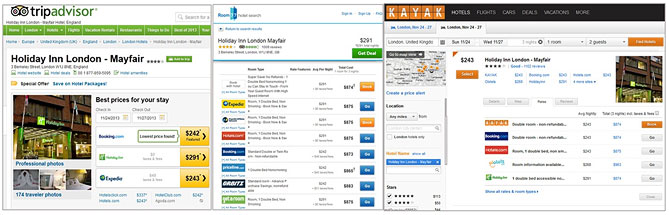

I did a random search for a hotel in three meta-search engines, namely TripAdvisor, Kayak and Room 77. As you can see from the screen shots, OTAs dominate the page ranking; even in a hotel industry controlled site like Room 77. Also clear from the screen is that rate parity prevails in this case. For a consumer, this is an apple to apple comparison, and gives an option to book from anywhere they want. Metasearch helps to identify rate discrepancies across multiple channels for a single property and gives a snapshot of overall rate behaviour at given market at a given time. In the current market, with price parity firmly entrenched, the OTAs are indistinguishable from their competitors from a pricing point of view and ironically prevents price-centric competitive actions to be taken to gain market share. In addition, this also creates consumer confidence, which in the long run, helps to build brand integrity and protects the direct channel. The loosening or the possible removal of price parity controls will increase the value of meta-search engines as they will provide a convenient way for consumers to find the cheapest rate across all channels.

Does size really matter?

The big OTAs are already spending billions on promotion and pay-per-click advertisements. Priceline and Expedia are among the top advertisement spenders on Google. As travellers spend more time on research, hotels need to be present at every touch point to their target audience. This is why, hotels need to evaluate each channels for the opportunities they present, and create tailor-made pricing strategies - all while staying within whatever rate parity constraints remain – for optimizing rate and revenue.

To start with, hotels need to look at analyzing margins from each channel and allocate rate and inventories with margin as base-line. Select channels that bring key value to their properties – ones that support not just when the circus is in town but on a rainy day. Online travel agencies like Expedia and Booking.com are now making suggestions to the customers based on their previous searches / purchases. With increased customer knowledge, hotels now have the opportunity to expand their product offerings based on preferences. With access to reservation reports to identify the customer demographics, hotel can develop intuitive packages to help customers actually find what they are looking for. The basic of every pricing strategy is to know the value of the product and the elasticity up to which consumers would be ready to pay.

That is why understanding different distribution platforms have become crucial for hotels. Without a foundation of platform based pricing it will be extremely difficult to manage pricing to the players sitting on the various levels of distribution, such as traditional OTAs, Same-day booking sites, GDS, Tour Operators Own Website, social media, mobile applications, fenced groups, loyalty programs, specific credit cards, and so on. By introducing a platform based pricing methodology, and maintaining parity within that platform, hotels can optimize their rate matrix while staying within their contractual obligations.

Say no to inventory parity

Pricing parity must never be confused with inventory parity. Due to the high disparity of actual yield between direct and in-direct distribution costs, hotels should utilize the option to limit inventory in high-cost channels. By all means, use rate parity for higher page ranking, and use the ‘Billboard Effect’ to be optimal by creating attractive packages, introducing different rate plans and room-types in the brand site to get more direct bookings. Rate parity issues often occur as a fall out of mismanagement of inventories across channels by hotels. Sophisticated allocation management tools allow hotels to assign a certain number of rooms to all connected channels, thereby eliminating the possibility of having a situation where room inventories will be available in one channel, and not another.

Mature distribution markets are moving from daily rate changes to real-time changes from a revenue management perspective which has a positive impact on profit optimization. Remember, price is only one of the four P´s of marketing. Give equal importance to other 3, namely product, place and promotion. Parity is not so evil after all, only misunderstood.

|