About 36.1 million people will be visiting Britain in 2016. Another 100 million overnight trips will be made by Britons, making it an exciting year for the UK tourism industry. In this two part series, I will look at trends that will become crucial for hotels to ride the tide as they put final touches to their summer preparations.

OTAs remain critical to success

Unlike other parts of Europe, online hotel sales in UK have always been dominated by the direct channel. However, according to a PhoCusWright report, OTAs are slowly but steadily increasing their market share with 35% of online hotel bookings coming from them. Data from our client hotels in UK also corroborate this trend. The rate parity issue notwithstanding, Booking.com remains the most popular online distribution channel for UK hoteliers. The top five channels being used by our client hotels also suggest a surge in popularity for last minute booking channel Laterooms, a trend that we have seen in the last couple of years. Other channels in the top 5 list are Expedia, Agoda and HotelBeds – a B2B sales channel.

This is an indication of how hotels are experimenting with the distribution mix– a combination of traditional OTAs, last minute booking – deal sites or B2B channels. To get the maximum gain out of their distribution mix, hotels need to balance exposure according to target market to improve occupancy and average rate. They need to develop a distribution plan to reach out to travellers coming from key markets like USA and Western Europe. Market knowledge, competitor intelligence and historical trends can help hoteliers to create an effective strategy.

If you are a small bed & breakfast type establishment, you can go for a mix of high commission, high exposure sites like Expedia and Booking.com along with low commission sites like Flipkey and budgetplaces. For hostels, dedicated sites like HostelBookers and Hostelworld can be good options. Boutique independent hotels can focus on niche OTAs with low commissions. Reservation analytics which identifies best performing channels, production pattern and booking pace can come in handy to select the ideal distribution mix.

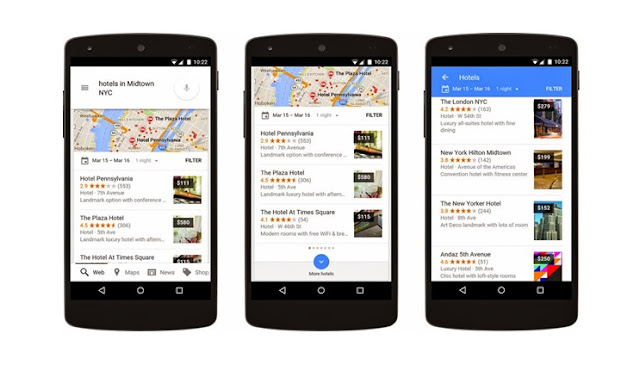

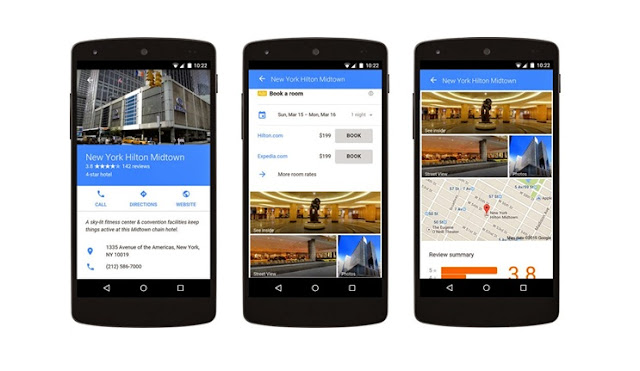

Mobile booking is mainstream

This takes us to the fastest growing booking platform – the mobile. One in every four online booking is now being made on mobile. Interestingly, while direct booking accounts for the majority of online bookings, when it comes to mobile, the scenario completely changes, with smartphones generating three times higher bookings for OTAs than hotel’s direct site. This clearly indicates hotels’ lack of preparedness in the mobile platform. The contrast is even more visible in the last minute booking segment – where 58% of the bookings coming from mobile devices.

As the mobile platform grows leaps and bound to become a mainstream sales channel, hotels have taken note. Mobile website is expected to be the most implemented technology among independent lodging providers. Invest in a booking engine providing seamless booking experience along with rich content and secure payment option.

Stay tuned for part two of this series which will be posted in mid May!