The fifteenth edition of TTG Incontri took place at Incoming Hall, Italy. With over 2,400 exhibitors and more than 1,000 top-quality buyers representing 85 countries, the exhibition was a milestone for the travel and hospitality enthusiasts.

I attended the event with my colleague Francesca Stagi to establish new contacts and generate new business in Italy. Thousands of hospitality and travel technology professionals from all around the world gathered under one roof to find new partners thus proving to be a meeting place between supply and demand. It was a great opportunity for us to understand new trends in Italian hospitality industry and pitching latest offerings from RateTiger.

Here are three trends I find the most important that are shaping Italian travel industry.

Influx of Inbound Tourists

Despite the slow economic progress, travel and tourism in Italy has seen a positive growth – thanks to influx of inbound tourists to the country. Italy is the third most popular destination in Europe in terms of tourist arrivals. In 2014, a whopping 48.6 million tourists crossed the borders to travel to the country and this number will only grow bigger this year thanks to a wide range of offers from hoteliers and online travel agents. This has made a positive impact in attracting large numbers of inbound tourists and the potential impact on Italian travel and tourism industry.

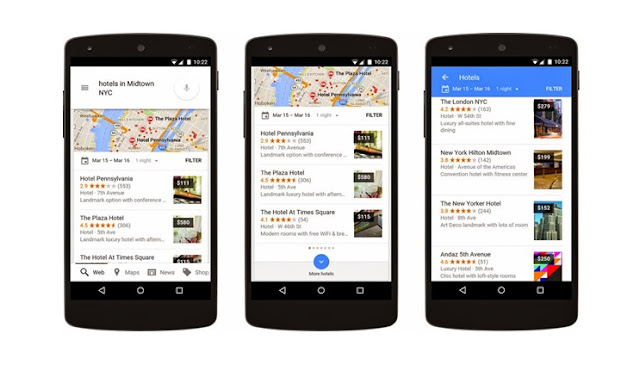

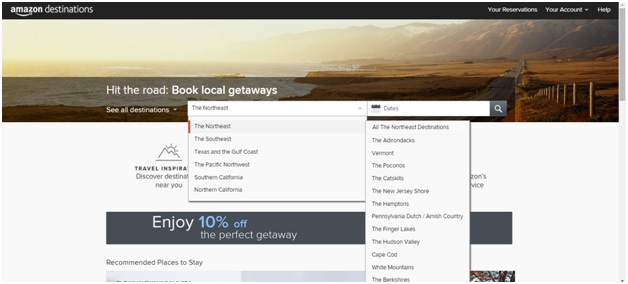

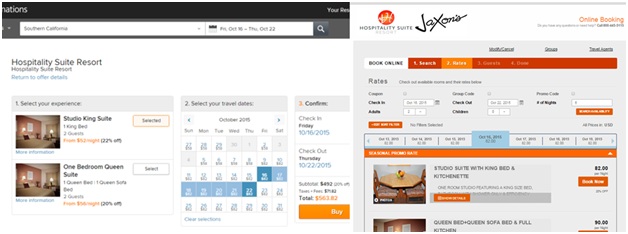

Mobile travel matters

While interacting with visitors and industry veterans in the exhibition, the one thing I observed is that the rise of mobile phones is the most prominent force behind the change of travel scenario in Italy. In particular, mobile transaction in travel generated a double digit value in 2014 led by widespread use of smartphones and tablets in Italy. Young and affluent travellers in the country are more comfortable with mobile apps and websites that forced the large number of hotels and online travel agents to use mobile as a channel to reach higher number of consumers.

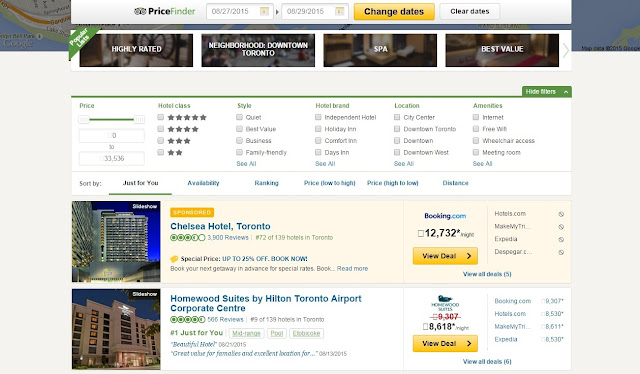

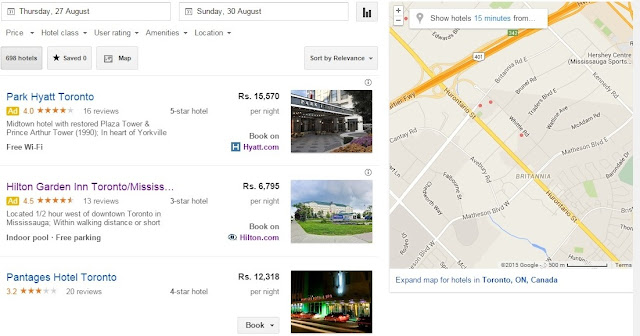

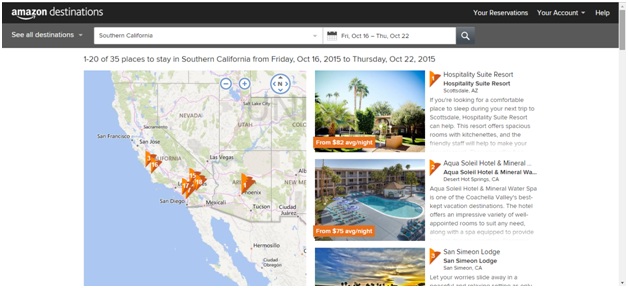

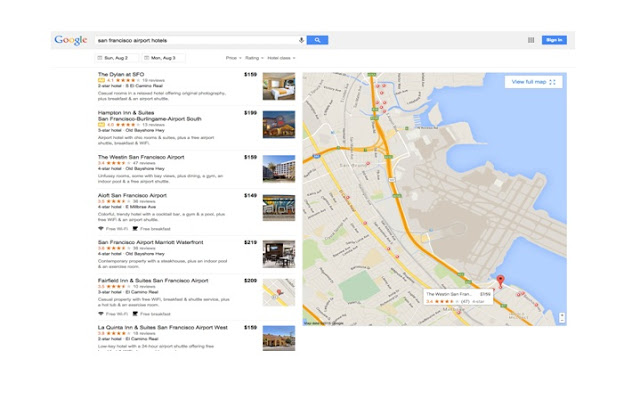

Oh! Online travel is booming

Last but not the least; online travel agents in Italy are the largest source of revenue generator when we talk about online travel. Booking.com is undoubtedly the king of online travel agents in Italy with 63% market share controlled by the OTA giant. Though three major OTAs (Booking.com, Expedia and HRS) rule the country, emergence of new travel agents in the Italian market and the rise of peer-to-peer services is going to influence the travel scenario in future.

The event was the cornerstone for us to showcase our recent developments in RateTiger products. This was also an opportunity for us to meet new partners and we are excited to start collaborating with them!

Claudia De Leo is the Sales & Marketing Manager at eRevMax. She can be reached at claudiad@erevmax.com.