In these uncertain times, travellers are looking for extra flexibility. As hoteliers, you need to cater to the ever-changing guest expectation to drive demand to your property.

eRevMax offer seamless connectivity to multiple channel partners to expand your online brand visibility. With the growth in domestic tourism, Booking.com is expecting almost 74% of bookings to come from a mobile phone. Adding a mobile rate to your property will increase your visibility with these customers and unlock your market potential with last-minute mobile bookings. You can update Mobile Rates on Booking.com directly from RateTiger.

The use of mobile in emerging markets has changed how travel is searched and booked and by managing mobile rates, you too can improve reservations coming from mobile bookers.

Did you know?

- 80% of travellers use a mobile app when researching a trip*

- 50% of accommodation searches and bookings are made on mobile*

- Mobile rates give partners 28% more bookings from mobile traffic*

- 2-in-3 mobile bookings are made by Millennials or younger customers. Everyone might search from mobile but Millennials book.

What is Mobile Rate?

A Mobile Rate is a special discounted rate that’s only visible when someone uses Booking.com’s app or accesses Booking.com’s website using a mobile browser. You can use Mobile Rates to increase your bookings from mobile devices by up to 28%. Mobile Rates are active throughout the year.

How does your business benefit from Booking.com’s mobile rate?

Attract more bookings

Offering mobile rate drives more potential guests to your property page.

Mobile rates on average give partners 26% more bookings from mobile customers.

Mobile rates on average give partners 3% higher click-through rate from search results to the hotel page.

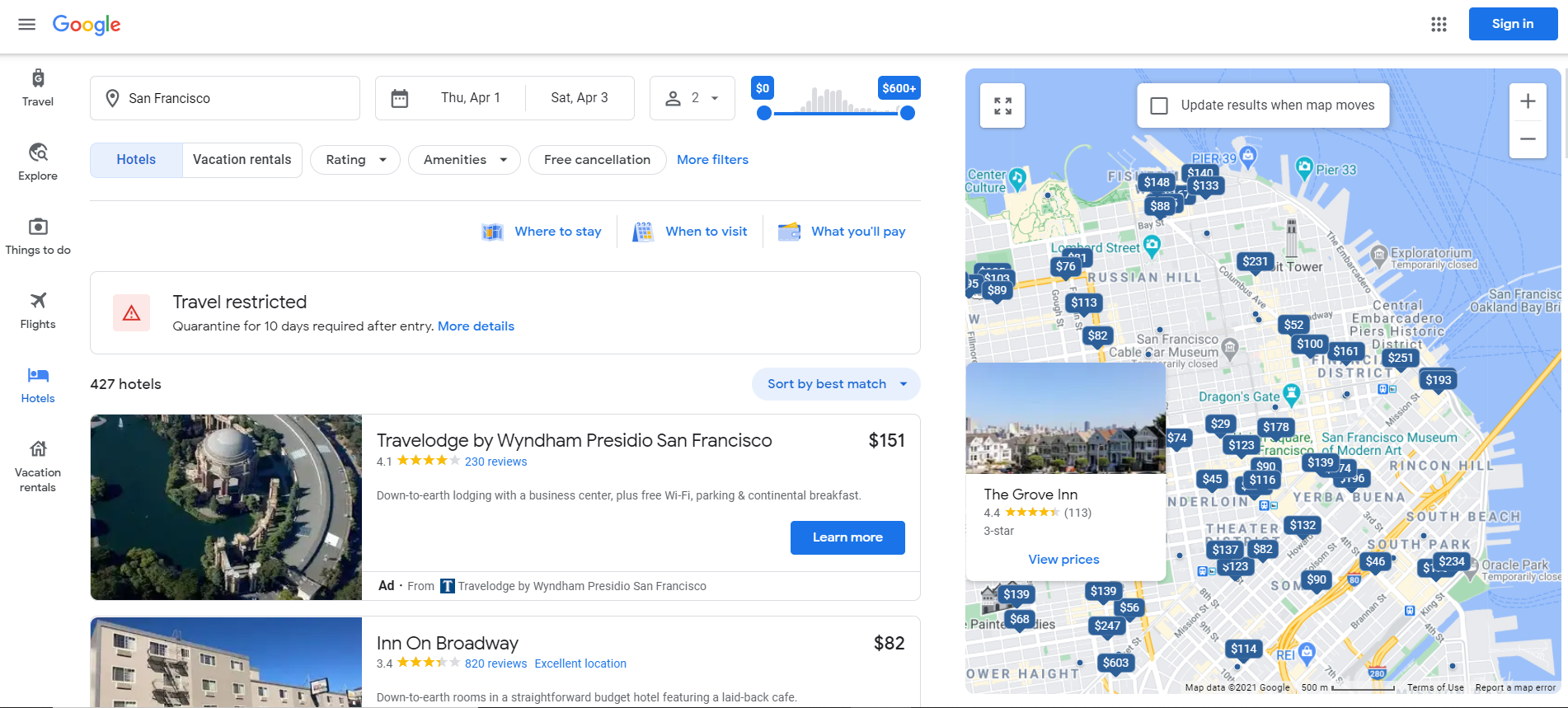

Stand out in searches

Once you activate the feature, a special badge will appear next to your property in search results and on your property page and during the booking process.

Position your property to digital natives who share experiences via social media.

Target mobile users with a special discount to encourage them to book your property immediately while they are on mobile.

Better price, better reviews, better ranking

Two-thirds of mobile bookings are made by millennials – who write more reviews than any other traveller segment. Attracting these bookers can positively impact your overall ranking on Booking.com.

Millennial smartphone ownership is rising: >94% in advanced economies, and >62% in emerging economies*. Attract this customer base with a special discount.

Avoid attention shifts to a competitor when they change device and start a new search process.

How Mobile Rates work?

How Mobile Rates work?

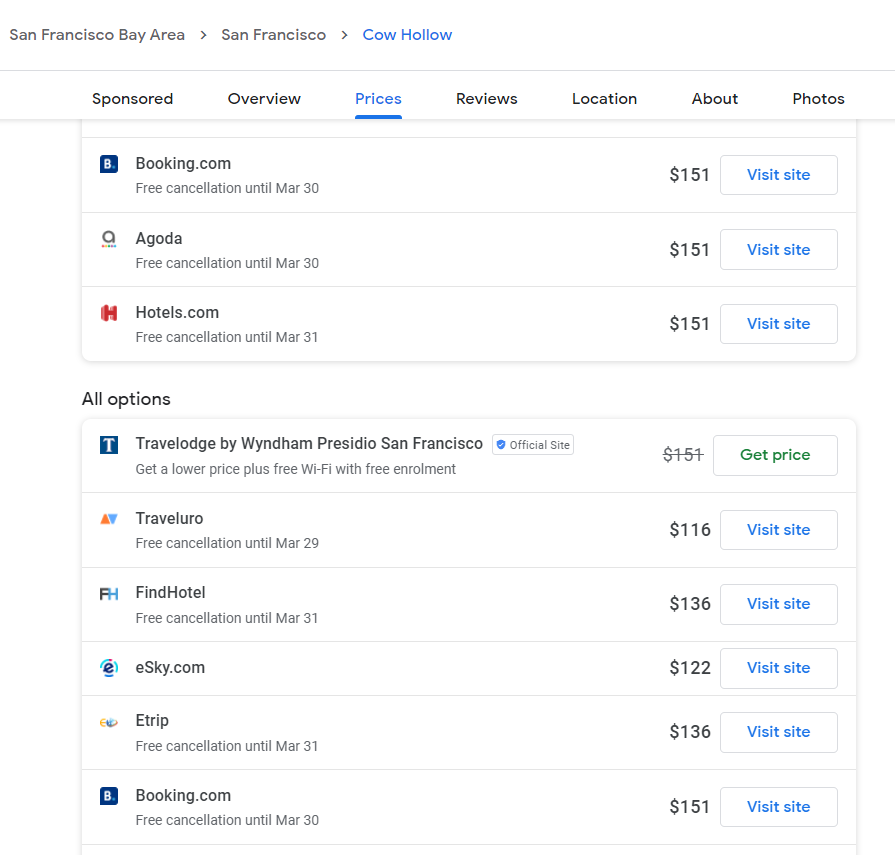

- Mobile rates are only visible to guests on mobile devices (on both the Booking.com app and mobile browsers).

- A minimum 10% discount is recommended.

- Mobile rates apply to all your rooms and rate plans. The discount combines with discounts for the Genius programme, as well as any other promotions you have set up. However, it does not add on to Country rate or Limited-time Deal.

- You can set up 30 blackout days per calendar year.

The majority of reservations on Booking.com’s platform is made using mobile devices, so offering a Mobile Rate helps you tap into this large group of potential guests. Mobile Rates can also help you target millennials. The property can activate, edit and deactivate the mobile rates any times.

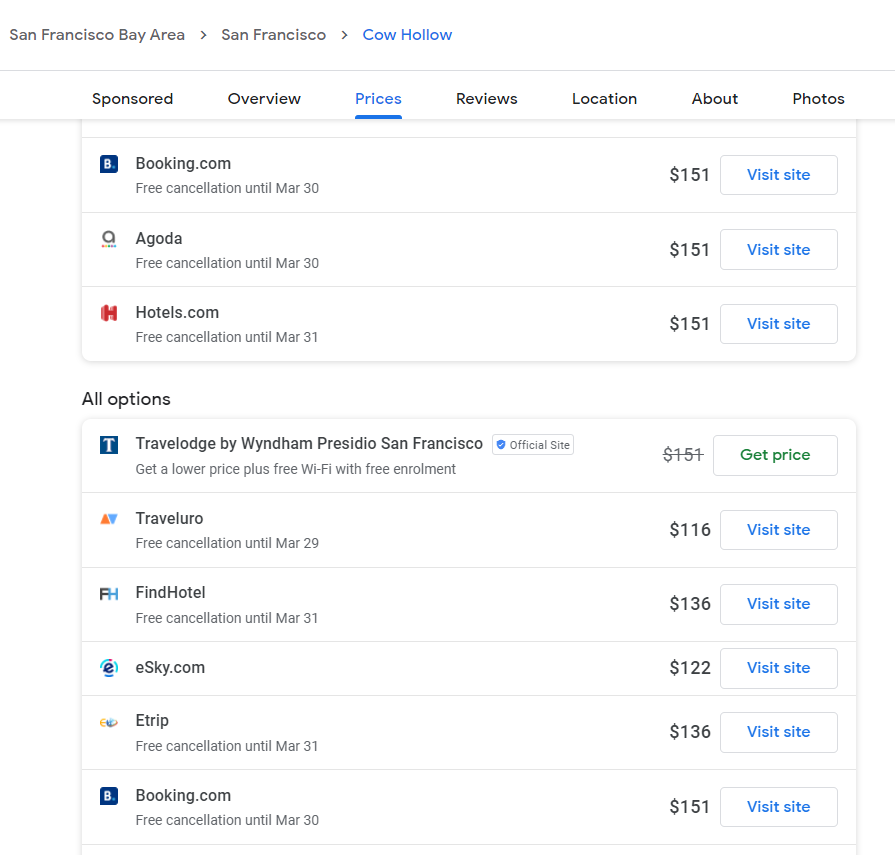

Creating Mobile Rates via RateTiger

If you do not already have a Mobile Rate set up for Booking.com, you can easily create one using through RateTiger.

- Log in to your RateTiger platform – https://live.ratetiger.com/#/login

- In the main dashboard, you will see the Promotions tile. Click on Create Promotion to go to the Promotions page.

- On this page, select Mobile Promo and then select the channel – Booking-XML

- Input the discount / promo and click on Create. The Mobile Rate gets created for Booking.com.

You can always update the settings of your Mobile Rates or deactivate them so that potential guests no longer see them.

Lastly there are a host of additional solutions through which your property can benefit and attract more bookings. You can get full details of the Booking.com Recovery Toolkit on the partner page.

RateTiger, powered by LiveOS, provides rate shopping, channel management, booking engine and online distribution solutions to hotels worldwide. It offers 99.9% system uptime and is security certified under ISO, PCI and GDPR compliant. eRevMax continues to expand its partner base through new integrations to offer hoteliers seamless connections across different systems including PMSs, CRSs, OTAs, Metasearch channels, GDS, Wholesalers and offline tour operators among others.

Subscribe to RateTiger today and start using this feature. Reach out to us for your connectivity needs to make the most of your online revenue- https://goo.gl/3gKUJZ

How Mobile Rates work?

How Mobile Rates work?