In the first part of article (see here) we mentioned two top performing online travel sites in UK. In this part we’ve discussed three other channels that come in top five lists and shaping the travel industry in UK.

Skyscanner

Primarily a flight comparison site, Skyscanner has forayed into hotel industry recently, but already making significant moves. The site has been one of the top travel search sites in Europe with 35 million unique visitors, and now with separate mobile app for flight, hotel and car hire the travel major is in a unique position offering complete package to potential travellers. According to Deloitte, Skyscanner, the hotel and flight comparison site has grown by over 42% from last year, a transformational phase which saw non-flight booking contributing to 47% of its revenue.

TravelRepublic

TravelRepublic is one of the largest and most well-established online travel agents in Europe, with over 2 million holidaymakers booking annually through their websites in the UK, Ireland, Spain, Italy and Germany. The OTA major has access to approximately 300,000 hotels, apartments and villas and receives over 1,000,000 visitors a week making it one of the most sought after online travel channels in UK.

Start-up Pitch

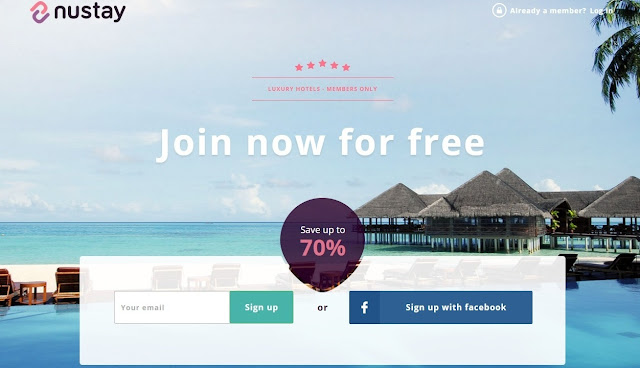

NuStay

Some of you are already aware about NuStay. It is a travel start-up launched in July 2015 with investors from London, Copenhagen, Oslo and Dubai aimed to provide travelers better booking rates and at the same time offering the hotels a way to submit unique offers to each individual guest, either manually or automatically, at a discounted rate. A PhoCusWright report shows that, 70% travellers prefers their suitable rooms at a discounted price and they wait for the right moment to book that accommodation. Accommodation providers consider luxury travel is their major source of revenue – around 77% accommodation providers sell luxury trips, making luxury travel one of the top revenue generating segment in online travel. This trend is the USP of NuStay- the company provides luxury rooms in budgeted price with its unique algorithm that finds best matched luxury hotels for their consumers. An interesting thing about this company is they negotiate discounted rates for its guests with their hotel partners which no other company has done yet.

You might have a team of revenue managers continuously updating your inventory on major online travel channels you are connected to but if you don’t keep an eye on these channels then for sure a large number of your rooms will remain vacant for the day- losing handsome revenue. As a major share of all hotel bookings are shifting from desktop to mobile this new types of channels are becoming a key distribution medium for your hotel distribution. Make sure your revenue managers are taking right decision and promotional tactics which is compatible to fulfil increasing demand of your potential guests.

Image Credit: NuStay